Historical Peaks and Troughs in the Platinum-Gold Ratio

The relationship between the prices of platinum and gold, often expressed as the platinum/gold ratio, is a fascinating indicator that can reveal much about the economic and geopolitical landscapes of different eras. This ratio fluctuates constantly due to a complex interplay of factors, including industrial demand, investor sentiment, geopolitical tensions, and monetary policy.

What is the Platinum/Gold Ratio?

The platinum/gold ratio is simply the price of platinum divided by the price of gold. A rising ratio means that platinum is becoming relatively more expensive compared to gold, while a falling ratio indicates that gold is becoming relatively more valuable.

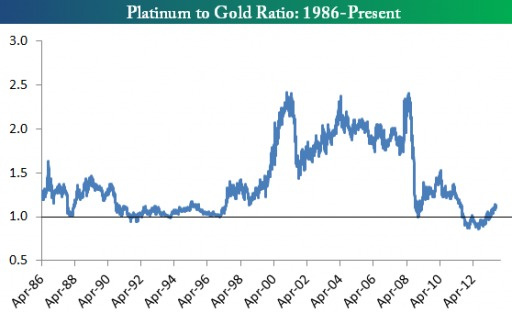

THE HISTORICAL DEVELOPMENT OF THE PLATINUM/GOLD RATIO. THE PLATINUM/GOLD RATIO IS OBTAINED BY DIVIDING THE PLATINUM PRICE BY THE PRICE OF GOLD. THIS RATIO, RELATED TO THE PLATINUM PRICE, IS USED BY INVESTORS TO DETERMINE WHETHER PLATINUM IS AN INTERESTING INVESTMENT (SOURCE: BESPOKE).

Historical Developments

1. The Industrial Revolution:

- Rising Demand for Platinum: The rise of the automotive industry and increasing demand for catalytic converters pushed platinum prices upward.

- Relative Stability: Despite industrial growth, the ratio remained relatively stable, with some temporary spikes due to specific events.

2. The Oil Crisis of the 1970s:

- Fleeing to Precious Metals: Investors sought refuge in precious metals as a safe haven, driving up demand for both platinum and gold.

- Increased Volatility: The ratio showed a significant increase in volatility, with both sharp rises and falls.

3. The 2008 Financial Crisis:

- Flight to Safety: Similar to the oil crisis, investors once again sought safe havens.

- Platinum Outperformed: Platinum benefited more from the crisis than gold, leading to a historic peak in the ratio.

4. Recent Developments:

- Increasing Uncertainty: Geopolitical tensions, trade conflicts, and economic uncertainty have further increased the volatility of the ratio.

- Electric Vehicles: The rise of electric vehicles has reduced the demand for platinum in the automotive industry, exerting downward pressure on the ratio.

Factors Affecting the Ratio

- Industrial Demand: The demand for platinum in sectors such as the automotive industry, jewelry, and electronics plays a crucial role.

- Investor Sentiment: Investors often view platinum and gold as safe havens during times of economic uncertainty.

- Geopolitical Tensions: Conflicts and geopolitical instability can boost demand for precious metals.

- Monetary Policy: Central banks can influence precious metal prices through interest rate decisions and quantitative easing.

- Supply: Changes in mining production and the availability of recycled materials can affect prices.

Conclusion

The platinum/gold ratio is a dynamic indicator that is constantly influenced by a complex interplay of economic, geopolitical, and industrial factors. Historically, the ratio has shown significant fluctuations, with both long-term increases and decreases. Investors interested in precious metals should consider the many factors that affect the ratio and adopt a long-term perspective.