The Yield Curve Just Keeps Getting Flatter (and Analysts Keep Looking for Excuses)

December 13 2017

Former Fed Chair Ben Bernanke studied it in detail decades ago: the yield curve. And that yield curve is currently flattening and flattening. An inverted yield curve (in which the short-term interest rate exceeds long-term rates), normally signals that a recession is near. As a result, analysts keep a close tab on the spread between short-term and long-term yields. Whenever the yield curve spread narrows, there is cause for alarm. And last week, the yield curve spread continued to decline even further.

Despite the recent flattening of the yield curve, there are various analysts who argue that this trend is absolutely no cause for concern: a recession is, according to them, highly unlikely, despite approaching at a frightening rate an inversion of the yield curve.

Who is right? What is behind the flattening of the yield curve?

Yield Curve Spreads Keep Falling and Falling

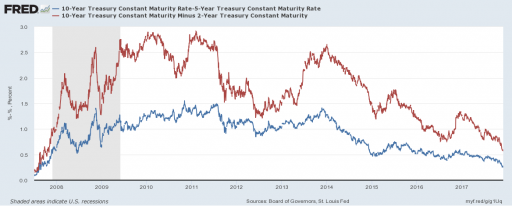

Different analysts use a variety of different yield curve spreads. The most popular, which is also directly available on the website of the St Louis Fed, is the spread between the 10-year and 2-year US Treasury. This spread declined last week to a mere 58 basis points, its lowest level since 2007 (on the eve of the Great Recession).

The spread between the 10-year and 5-year yields is also often used. This spread dropped to just 26 basis points and is as such only a hair removed from turning negative (a negative spread would indicate an inverted yield curve).

The yield curve spread is falling, are we approaching an inverted yield curve? Source: St Louis Fed

Al this leads to increasing speculation in the financial press about a new recession. But, as some analysts argue, this time around we should not be worried about an inversion of the yield curve. Let us briefly go through their arguments to see whether or not the recent trend should worry us.

The Fed Manipulates the Interest Rate, Hence the Yield Curve Is Useless

The Fed has been engaging for years in massive yield curve manipulation. The short end of the yield curve (short-term rates) are purposely being kept low by the Fed, as our yield curve deniers argue. As a consequence, yields – which exclusively depend on the Fed – no longer say anything. To count on the yield curve for forecasting a recession is therefore incredibly foolish. The rules have changed. An investor should no longer worry about the yield curve.

That is all well and good, but if this argument would hold, then it would be the other way around! It is not necessary for the yield curve to invert to provide an early warning sign of an impending recession. If the Fed manipulates the short end of the curve, the yield curve would be, all other things equal, more upward sloping. A mere fattening yield curve would already imply a recession is approaching, even if the yield curve does not invert.

The Current Trend Is Completely Expected, Since the Economy Is Improving and Rates Rise!

After all, we have been coming out a recession period and now find ourselves in a renewed growth phase. More economic activity means more demand for credit and more demand for credit translates into higher interest rates.

This argument, however, does not make any sense. The reason why is simple: when the economy is supposedly improving, long-term interest rates rise faster than short-term rates. As a result, the spread should increase, not decrease. The yield curve should become steeper, not flatter.

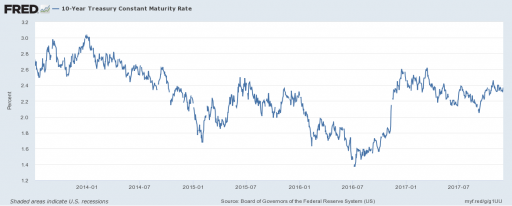

And the best of all? The long-term interest rate does not even rise! Better yet, compared to January the 10-year US Treasury rate is currently lower than at the time.

Long-term US interest rates are not even rising! Source: St Louis Fed

But on the other hand, those very same analysts argue that the reason for the yield curve to flatten, are the rate hikes by the Fed. Better yet, it is almost a certainty that the Fed will raise interest rates once more later this month. As a result, they argue, a falling yield curve spread should be of no concern.

That this interpretation is rather besides the point, should be evident by the mere fact that the recession of 2008 also followed from a series of interest rates hikes by the, at the time, Fed Chair Ben Bernanke. He began in 2005 a trajectory to gradually raise interest rates, comparable to what Janet Yellen & co are doing today. But this did not mean that a recession is out of the question. With his subsequent rate hikes, Ben Bernanke unleashed the worst recession since the Great Depression of the 30s and the yield curve, as expected, simply inverted as always (the yield spread turned negative).

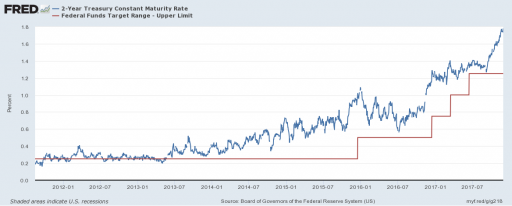

But besides all this, the Fed cannot simply manipulate the short-term rate for eternity. The following chart shows precisely why the Fed does not hold this type of power:

Source: St Louis Fed

In the above chart, we can observe two lines: the red line is the rate which the Fed targets (the so-called Fed funds target rate), while the blue line is the 2-year US Treasury rate, which we used earlier to calculate one of the yield curve spreads.

What should become clear immediately?

The fact that the short-term yield began rising already three years before the first rate hike by the Fed. And this increase was significant. The 2-year Treasury went from 0.2% to 0.8% in 2016, a four-fold increase before the Fed even began considering to raise interest rates for the first time since the Great Recession of 2008. After the first rate hike, the 2-year rate then began to decline, to only later rise again at the time of a third rate hike. But a fourth rate hike, however, did little to changes the 2-year Treasury rate.

And the past few months? Interest rates shot up from 1.25% to 1.8%! And that while the Fed supposedly would only raise rates to 1.5% in December. Why would the 2-year US Treasury rate rise strongly if the Fed is only about to raise rates to 1.5%? You might have guessed it by now: the Fed is not the only factor that determines short-term interest rates.

The thesis that the short-term rate rises exclusively because of the Fed, should therefore be discarded.

Conclusion

The yield curve remains as informative as always. The impressive track record of this important recession indicator will prove itself yet again. It is only a question of time before yield curve spreads become negative and the yield curve inverts. And this time around, an inverted yield curve will just as in earlier times indicate that we are on the brink of a new recession. A recession that has been due for some time now.

And that means good news for gold prices, dear reader. Especially in second instance. A new banking crisis means good times are coming for safe havens such as precious metals still are.

On the other side, a recession means bad news for the stock market, about which I wrote as recently as last week. And that is precisely the reason why many stock market analysts try to reason away the yield curve with unconvincing arguments. Since in a bull market, bad news will absolutely never be welcomed.

History repeats itself again and again.omg