Fed Raises Interest Rate and Winter Is Yet to Come

December 19 2017

Even though large parts of the world were colored white over the past week (large parts of Europe and the U.S. were covered in snow), the proverbial economic winter is yet to come. Last week, as we expected and already explained in one of our previous articles, the Fed announced another rate hike, this time from 1.25% to 1.5%. Moreover, Fed Chair Janet Yellen said she expected the Fed to continue their rate hike trajectory in the coming years. The Fed board is forecasting three more rate hikes in 2018. Yet, Yellen seems dangerously unaware of the danger that lies ahead. She made a few highly remarkable comments on interest rates and the yield curve in her press conference. How did credit markets react to the Fed´s decision and what can we expect in 2018?

Fed Raises Rates

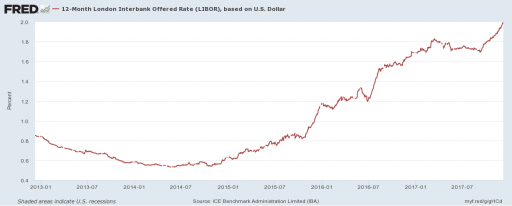

Nothing unusual here. We already informed our readers to expect a next rate hike at this December meeting, this time bringing the Fed funds rate to an upper limit of 1.5%. But credit markets have shown a total disregard for the Fed. Interbank rates were already far above that 1.5% Fed rate and kept increasing at a rapid pace over the past week. Short-term interest rates are rising.

While the Fed raised interest rates from 1.25% to 1.5%, the interbank market (12 month) rate increased even more. Source: St Louis Fed

Short-term Rates Are the Basis for Many, Many Loans

Because banks want as little exposure as possible to changes in market interest rates (a commercial bank lives, after all, on the margin between what it on the one side pays for capital and what it on the other side earns on its invested capital), many bank loans are based on an interest rate that consists of two components:

- The LIBOR (for instance the 12-month US dollar LIBOR) rate

- A fixed premium

The idea behind this structure is that the liability side of a bank´s balance sheet can be financed roughly at LIBOR. And by investing everything on the asset side against LIBOR plus a premium, profits appear to be guaranteed. Appear, because in the long run profits are only made when the bank can also avoid massive defaults and write-downs on its asset side.

So, what is currently happening?

Short-term LIBOR rates are increasing rapidly, at a much faster pace than the Fed is currently raising interest rates. Now, interest rates still seem low, but that is beside the point. What counts, is the impact of increasing rates on the cost of servicing debt. Exactly two years ago, the 12-month USD LIBOR was as low as 0.5%. Today, that very same interest rate stands at 2%. That amounts to a fourfold increase in interest expenses.

For the moment, or ever since the crisis of 2008, households have been acting more responsibly with their finances. US households are less leveraged (that is, less indebted relative to their net worth and income) than ten years ago. But these apparently healthy household finances will deteriorate rapidly as soon as the labor market worsens and workers begin losing jobs.

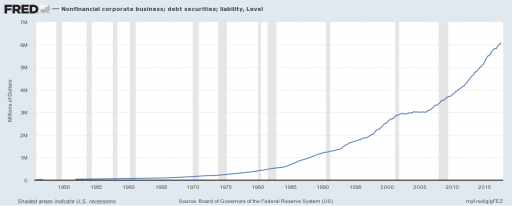

What we should be looking at, is therefore the impact of this increase in the 12-month USD LIBOR on the interest expense of corporate businesses. In the third quarter of this year, the total debt of U.S. nonfinancial corporations equaled over six trillion (six thousand billion!) dollars, an all-time record high.

I am not alone in arguing that these corporate debt levels are simply too large. According to a survey by Bank of America among U.S.-based fund managers, a record share (twenty-three percent) of stock market investors think publicly listed businesses hold too much leverage. And with corporate debt at record highs, the first dominoes are bound to fall rapidly when interest rates and interest expenses rise even further.

Corporate debt was never as high as today. Source: St Louis Fed

But the Fed Is Not Concerned about the Yield Curve …

While we have been discussing the yield curve on numerous occasions over the past few weeks, Fed Chair Janet Yellen said at her press conference last week that while monitoring the yield curve (the term premium), she and her fellow board members are completely convinced that apparently the yield curve is for the first time in history of no use.

Fed Chair Janet Yellen commented the following in last week´s press conference on the predictive power of an inverted yield curve:

“So this is something that we discussed and have looked at. The yield curve has flattened some as we have raised short rates. Mainly, the flattening yield curve mainly reflects higher short-term rates. The yield curve is not currently inverted, and I would say that the current slope is well within its historical range. Now there is a strong correlation historically between yield curve inversions and recessions, but let me emphasize that correlation is not causation, and I think that there are good reasons to think that the relationship between the slope of the yield curve and the business cycle may have changed.

(…) that means that structurally, and this can be true going forward, that the yield curve is likely to be flatter than it's been in the past. (…)

Now, I think it's also important to realize that market participants are not expressing heightened concern about the decline of the term premium, and when asked directly about the odds of recession, they see it as low, and I would concur with that judgment.”

The idea that the yield curve has flattened “some” (or somewhat) is completely ridiculous. The last time the yield curve was this flat, was in 2007, right before the Great Recession. But that might be the least surprising of what Janet Yellen said in her last press conference for the year.

The point is that many economists, including Fed Chair Janet Yellen and her board, think that long-term interest rates are a mere extrapolation of the current short-term interest rate. The yield curve as such is a result of or a function of the short-term (overnight or 24-hour) interest rate and the “term premium” on the long-term interest rate, which is a function of mostly inflation. Short-term interest rates are the only ones that count. To understand why this theory is wrong, we would need an entire course on the subject. But put briefly: this principle works as long as banks finance themselves with short-term liabilities (with generally demand deposits such as your bank debit account) and invest in long-term assets (such as mortgages, commercial credit, etcetera). But banks should, in fact, match the maturities of their liabilities (deposits, bonds, etcetera) with the maturities of their assets, or they risk illiquidity.