The Alternative Truth of the ECB and All the Consequences This Entails

February 21 2017

The central banks of the three developed economies – the U.S., the Eurozone and Japan – have expanded their balance sheets tremendously over the past decade. More than $12.2 trillion of financial assets now sit idle on their balance sheets. One of the consequences is that the central bank’s traditional toolkit has become obsolete. Central bankers count on one tool and one tool only. However, the effectiveness of this tool, especially in times of high and increasing inflation, is completely shrouded in mystery. Balance sheet reduction is one possible way to shrink the balance sheet so that traditional tools might be used, but how? And what are the consequences?

Banks Do Not Credit Create “Out of Thin Air”

First another thought experiment. Where does “credit” come from? Do banks create credit? The answer is, again, no. Banks are called “financial intermediaries” for good reason: only companies and households can save and borrow.

Central banks tried to manipulate the short-term interest rate by either increasing or reducing the supply of bank reserves (in other words, the deposits that commercial banks hold at the central bank). Banks were limited by the bank reserves that they held. A central bank managed the entire supply of bank reserves, since these reserves are simply the liabilities of the central bank; the central bank can easily expand or contract them. When a central bank sold assets, the amount of bank reserves in the banking system as a whole would decline. As a consequence, banks were forced to shrink their balance sheet in order to have sufficient reserves, either by raising interest rates or call in loans.

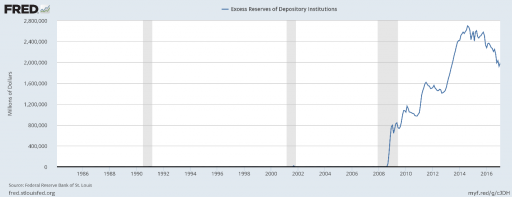

Until, as I wrote earlier, central banks began with “large asset purchase programs,” better known as “quantitative easing.” This involved the central bank purchasing assets on a massive scale, according to a fixed period and monthly purchase amount. As a result, the supply of bank reserves went through the roof. U might recognize the following chart:

Source: St Louis Fed

What you can observe here, was – as most of us now realize – not the onset of hyperinflation. But it was the moment that the Fed, and the other central banks, destroyed the mechanism – the manipulation of the supply of bank reserves – we described above. There were – and there are – so much bank reserves, that banks are no longer limited by the amount of bank reserves in the system. The traditional mechanism has become obsolete.

Then, what is stopping private banks from expanding credit? By the following:

- The supply of interest-earning assets that they have at their disposal

- The capital constraints that these interest-earning assets imply

And how do central banks pretend to execute monetary policy? Read on.

The Revolution in Central Banking, But Nobody Knows How This Will End (Including the Central Bankers Themselves)

Ever since quantitative easing, central banks have adopted a different method: they began paying interest on reserves (IOR). The idea is that by increasing or lowering the rate on these bank reserves, banks do not extend loans that have a (risk-free) rate below the central bank’s rate. In other words, when the central bank increases the interest rate on these bank reserves, the idea would be that banks would reduce their balance sheets (and inflation does not get out of control!).

There are two big problems with this new, untested method:

- The period (the gap) that exists between increasing the interest rate on bank reserves before it has any effect on inflation is completely unknown. How long does it take before a rate increase on bank reserves has truly an effect on inflation?

- There exists an important difference between nominal and real interest rates (the nominal rate minus inflation). Increasing rates on bank reserves involves nominal rates, but the real rate could even with a nominal rate increase go down in real times when inflation rears its ugly head. It might be the case that the central banks are constantly one step behind when inflation rises: increasing the nominal rate on bank reserves would be completely futile when the real interest rate is decreasing. Remember that this does not play any role in the old, presently obsolete methodology of the central bank: simply by manipulating the supply of bank reserves the desired effect could be brought about, no matter what.

These two problems are, in fact, two sides of the same coin. And they lead to the same conclusion: central bankers blindly trust the metaphorical quack (that is, interest on reserves), in case a tumor (that is, inflation) starts growing.

Today, we find ourselves in uncharted territory. Or as I have repeatedly said before: central bankers have embarked on the largest monetary experiment in the history of the world, with you as guinea pig.

What Are the Consequences for You?

What does all this mean for you personally?

The next time that inflation begins to rise – and that next time is very near if we take a close look at the increasing inflation rate in the Eurozone (and certainly in the U.S., too) – we have central bankers, firemen, that will extinguish the inflation inferno not with water, not with foam, but with a completely untested extinguishing method.

Inflation in the Eurozone, source: Trading Economics, data from Eurostat

And it is highly likely that their new extinguishing method will not work, with a completely out of control inflation that has not been fought off in time as a result. If we get at that point, after inflation got out of control, we will look back at the period of “large asset purchase programs” or QE as a completely failed and reckless experiment.

But investors in gold, of course, already knew that central bankers have no clue what they are doing.