10 Terrifying Charts

October 18 2016

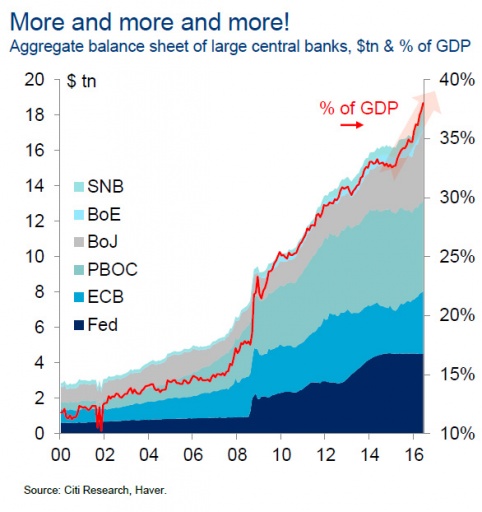

This week we will take a visual approach. I will share with you collection of ten graphs that might give pause for thought. We live in exceptional times: never did central banks exert so much influence on our lives. Many savers, investors and pensioners own a metaphorical pie in the sky. The present value of their riches is greatly overstated because of extreme central bank policies. And these charts will show you exactly what this means. Below you will find 10 startling statistics. Click on the charts for a larger version.

This is the reason why I TALK in my previous articles and presentations about "the largest monetary experiment in world history." All central banks take part in it. Never ever was the role of central banks so important. To be precise: almost 40% of global GDP is in hands of central banks around the world. The SNB is, by the way, the Swiss central bank, the BoE the famous Bank of England, the BoJ the Bank of Japan, the PBoC the People's Bank of China and the US Fed and the European Central Bank (ECB) are perhaps better known.

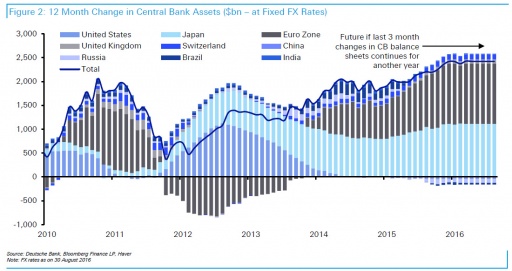

And central banks are not done yet. at times it appears to be a relay race. Now the ECB and BoJ have taken over the baton from the Federal Reserve. With their enormous purchase programme's, it's the central banks in Europe and Japan that are currently expanding their balance sheets in the most extreme manner.

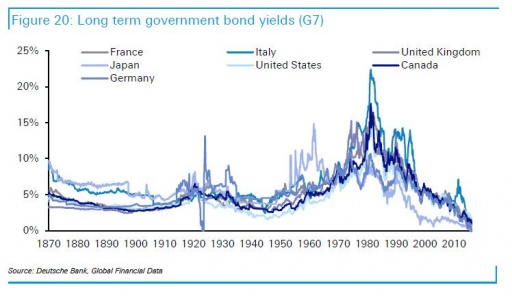

This madness of central banks has had one important consequence: interest rates were never this low. In Europe in many cases even negative. Investor Paul Singer talked to his participants about "the biggest bond bubble in history." He wrote in a letter to his investors that central banks "broke" the bond market, with all the negative consequences this entails down the road.

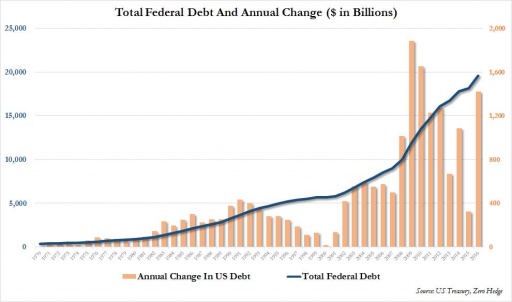

What incentive do persons have when credit is offered ultra cheap, for free, or even against payment? You could have guessed it: borrow! And the US government is no exception. It is easy to be president when you borrow $9 trillion (!) dollars.

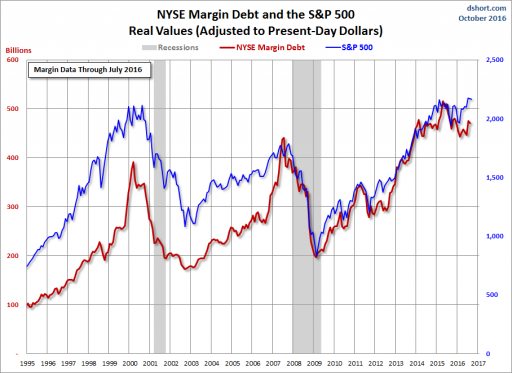

Not just the US government reacted to this stimuli of low or zero interest rates: stock market investors joined the party as well. Never did they use so much credit to invest in stock markets. A recipe for disaster: when the value of stocks drops slightly, many of them will be forced to sell their stocks to pay off margin debt.

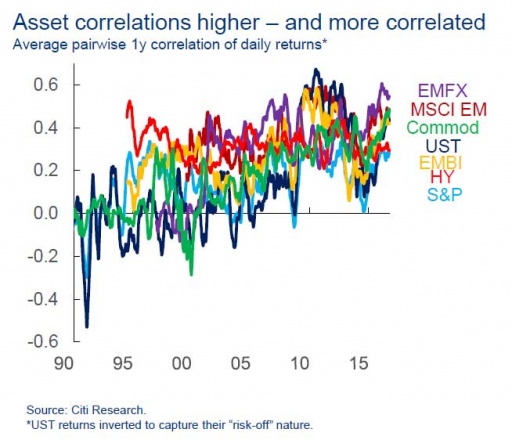

Another consequence of the current central bank policies is that the correlation between different asset CLASSES has increased SUBSTANTIALLY. No magic here: the central banks buys almost everything nowadays. Diversification is senseless in a world in which central banks call the shots.

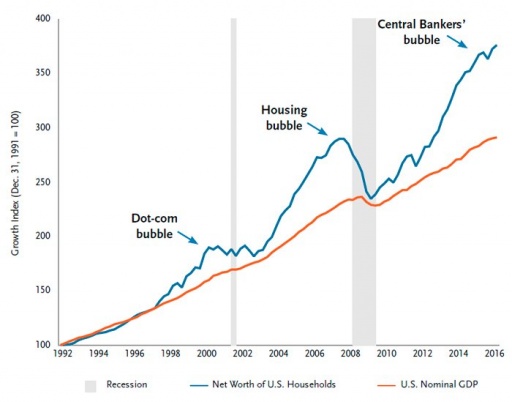

The extreme central bank policies have resulted in one thing: a next gigantic asset bubble. This bubble, like any other, can end in one way and one way only: in a massive crisis. This is a chart with US GDP growth (orange line) and the net worth of US households (blue line), which consists of stock portfolio's, home equity, savings accounts, etc. minus any household debt). Again, we are gazing into an abyss.

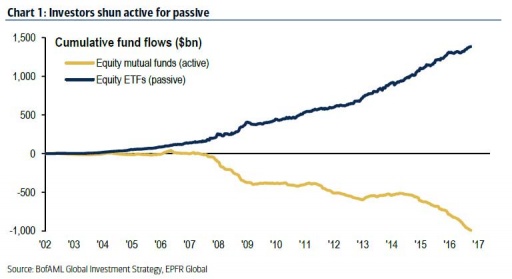

But an increasing number of investors invests passively by means of index funds. This has led to a worsening of the situation, since index funds do not care about the underlying value of the stocks or bonds in which they invest. The downfall of index investing will be a key symptom of the next global crisis.

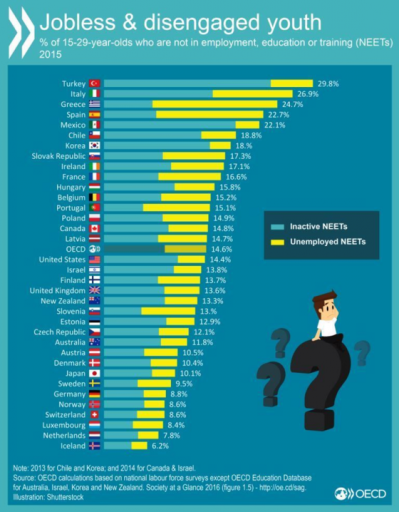

All of the above takes place in an environment in which worldwide an increasing number of young people are excluded from the social market process. They have no jobs, no studies and no training. They are disengaged. Outliers are young people in Italy and Spain who are completely disenfranchised. We could justify the term "lost generation" by looking at these stats.

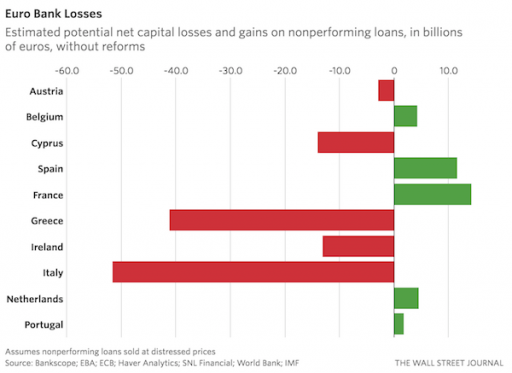

And in the meanwhile the European banking sector has not been cured yet. Despite record low financing costs, despite the extreme policy of the ECB, despite everything delinquency rates on bank loans is starting to creep up. Non-performing loans on Italian banks' balance sheets are a case in point. This chart is an estimate of the losses that still have to be taken. Will the euro be able to survive?