New record for gold! Thanks to the Fed

March 21 2024

►Gold hits a new record of €65,431/ kg, driven by FED's interest rate decision.

►Central banks, notably China, aggressively increase gold reserves, underscoring gold's investment appeal

►Retail investment in gold surges, with China leading in consumer demand.

BREAKING NEWS

FED Boosts Gold to Record Heights

During the recent meeting of the Federal Reserve led by Jerome Powell, it was decided to keep the current interest rate in the United States (5.25-5.50%) unchanged. Nevertheless, the Fed hinted that there could be three rate cuts later this year. However, the Fed remains vigilant and emphasizes that any decision will depend on progress towards the inflation target of 2%. With an inflation rate of 3.2% year-on-year this month, all eyes are on the publication of the next inflation data on April 10. Market expectations are leaning towards a possible rate cut in June, which has recently contributed to an increase in gold and silver prices.

Gold prices traditionally have an inverse relationship with interest rates: when rates fall, the price of gold tends to rise. Despite this theory, since March 2022, when the Federal Reserve raised interest rates after a long period of 0%, we've observed a notable 20% increase in the price of gold. This rise can be attributed to various significant events that caused geopolitical and economic uncertainty, including the conflict between Russia and Ukraine, a banking crisis in the US, and the conflict between Israel and Hamas, as well as the upcoming elections in the US at the end of this year. The anticipation of a possible rate cut is pushing gold to record highs, and analysts see room for further increases in the price of gold.

Central Banks Continue to Accumulate Gold

Globally, central banks remain active in adding gold to their reserves, a strategy that has paid off for many countries over the past years. In contrast, the Netherlands has put the purchase of gold on hold for some time. With a current gold reserve of 612,500 kilograms, the Netherlands now has gold reserves valued at approximately 40 billion euros. Interestingly, the value of these reserves has risen by nearly 3 billion euros since the beginning of the year, marking an impressive return.

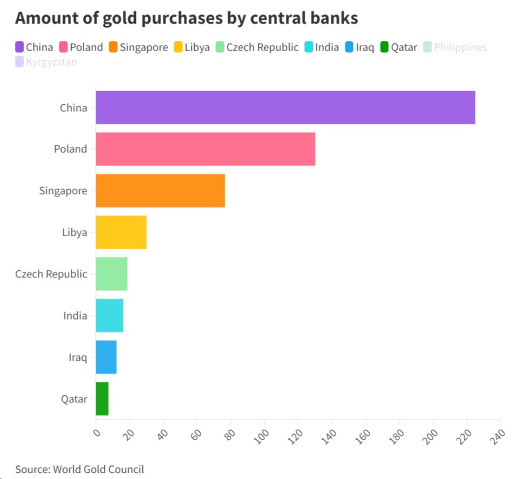

China is the main driver behind both consumer demand and central bank gold purchases, and the country is unlikely to slow down its acquisitions. Among all central banks, the People's Bank of China was the largest gold buyer in 2023. China's weak economy and challenges in the real estate sector have driven more investors towards the safety of gold, with continued strong individual investment in gold, according to the World Gold Council. Below is an overview of the central banks that have bought the most gold in 2023.

The reason Poland has purchased so much gold is straightforward. The proximity of the conflict in Ukraine has prompted the Polish central bank to actively seek ways to enhance the country's financial stability.

SOURCE: world gold council

Retail

Another driver of the gold price comes from retail investors. In addition to the significant purchases by the People's Bank of China, which bought the most gold among the world's central banks, China also recorded the highest volume of retail gold purchases. China played a crucial role in the strong demand for gold at the consumer level last year, as individuals diversified into gold from other asset classes. According to data from the World Gold Council, China surpassed India as the world's largest buyer of gold jewelry in 2023, with a purchase of 603 tons of gold jewelry, an increase of 10% compared to 2022.

Interestingly, the rise in gold prices has so far received relatively little media attention in the Netherlands. Google search volumes also lag behind, despite the new record. Where could the gold price climb if it does receive worldwide media attention?

Buy Gold